Can I get a loan if I am not a member?

You will need to establish membership as part of the loan process. You are eligible for membership as long as you live, work, go to school, or worship in one of these counties:

Autauga, Baldwin, Blount, Calhoun, Cherokee, Coffee, Colbert, Cullman, Dallas, DeKalb, Elmore, Etowah, Fayette, Franklin, Geneva, Houston, Jackson, Jefferson, Lamar, Lauderdale, Lawrence, Lee, Limestone, Madison, Marion, Marshall, Mobile, Montgomery, Morgan, Pickens, Pike, Randolph, Shelby, St. Clair, Talladega, Tuscaloosa, Walker, Winston

Establishing membership is simple if you are eligible. We simply require a $5 deposit in a savings account, which purchases a share of ownership in the credit union and allows us to provide you with our services and products.

Can you help me figure out a budget for an auto purchase?

This handy calculator should help you see how much you can afford.

Questions About Specific Types of Loans

What kind of mortgage loans do you offer?

We offer portfolio loans that will stay with Avadian, and we also offer FHA, VA, and USDA mortgages. We also finance construction loans with our one-time-close construction-to-permanent mortgage.

How do I get pre-approved on a mortgage?

You can begin the application process here or visit your local branch.

Do you offer mortgages for mobile homes?

We do not offer mortgages on mobile homes. We apologize for the inconvenience.

How do I make an appointment to speak with a Mortgage Loan Officer?

Just complete this form, and someone will get in touch with you.

How much money can I borrow with a personal loan?

You will need to talk with a Loan Officer about how much you can borrow on a personal loan. You can reach out to a Loan Officer by emailing consumerorigination@avadiancu.com.

Can I refinance my auto loan with Avadian?

Yes, you certainly can. You can apply right here. Simply select “refinance” on the second page.

How long can I finance a travel trailer?

We offer terms up to 180 months for RVs and travel trailers.

How long can I finance a boat?

We offer terms up to 120 months on boats depending on creditworthiness and age of the boat.

I want to contact someone about Avadian’s auto loan options. How can I reach someone?

You may email consumerorigination@avadiancu.com or call 205.985.2803 to speak directly with someone on our Consumer Origination team.

How long can I finance a motorcycle?

We offer terms up to 84 months on motorcycle loans.

HELOCPlus+

I already have a HELOCPlus+. How do I lock in a portion at a fixed rate?

Stop by your local branch, and the manager or Financial Services Officer can help you complete the process to lock in a rate for the “Plus” part. To make an appointment to visit a branch, click here.

Do you offer payday loans?

No. We do not offer payday loans.

Making Loan Payments

How do I make a loan payment?

You will be able to make a loan payment from any account you have with Avadian or by linking an external account (see question about linked accounts for more). Select “Payment and Transfers” then “Loan Payments,” then choose the account you’d like to use to make the payment from the drop-down menu.

You may make a payment as a one-time transfer or set up a recurring transfer.

What is a linked account?

A linked account is an account from another financial institution that you can link to your Avadian account.

There are three main ways to use linked accounts:

- Add an external account or loan for budgeting purposes. Under “Money Manager,” select “Link Account” on the online and mobile banking home page then enter or select the financial institution that holds the account you want to link. Enter your online credentials for the other institution’s site. This information will be viewable only and will not allow transactions. Read more about Money Manager here.

- Transfer funds to or from an account at any domestic financial institution. Go to “Account Actions” then “External Account – Add” from the online and mobile banking home page to enter the account information.

There are two ways to do this:

a. Verify the accounts with Micro-Deposits (small amounts of money deposited into an account that you will then enter to confirm the correct account is being used for the transaction) to confirm the process.

b. Verify the accounts with Instant Verification.

- Transfer funds from one member to another and save the account number if you frequently transfer money to that person. Select “Payments and Transfers” then “Member to Member.” You will use the normal verification for member transfer to complete the process. The account will then be available in the drop-down menu of the transfers screen, and you can also “nickname” the account in account preferences for future use.

What’s the best way to link an external account for external transfers?

The fastest and most secure way to link an external account is to use instant verification.

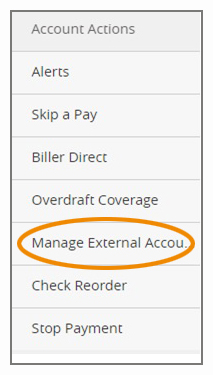

From the online and mobile banking home page go to “Account Actions” then “Manage External Accounts.”

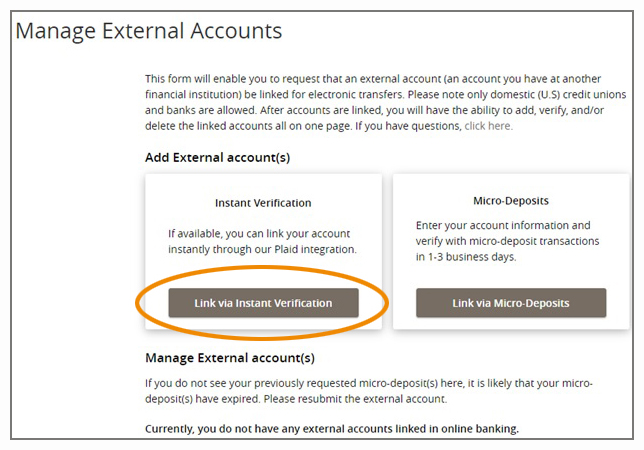

To verify instantly, select “Link via Instant Verification.”

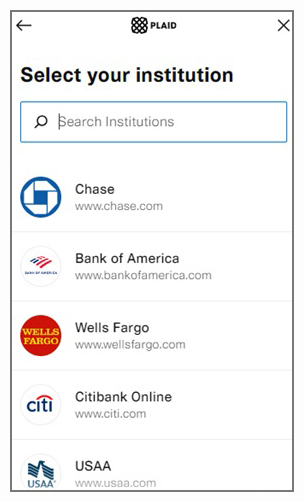

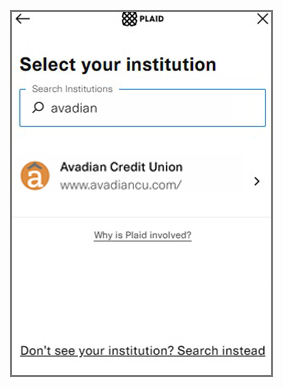

You’ll then be prompted to select “Continue” to agree to Plaid’s privacy policy and continue with the set-up. To select the financial institution you wish to link for external transfers, either select it from the list or enter the name in the search field. (If your financial institution is not found in Plaid, you will be unable to link accounts using Instant Verification.)

You’ll then be asked to enter your online banking credentials for that financial institution before choosing the account you wish to link.

If you are unable to link through Instant Verification, it may be because you have entered incorrect online banking credentials (username and/or password) with the other financial institution, the linking financial institution doesn’t have identity enabled, or there was a multi-factor authentication error.

I’m having issues linking my external account using instant verification. What can I do to fix this?

First, verify with your other financial institution that you are using the correct username and password to log in to that external account. If that is correct, verify how your name is listed on the external account. Your name must be listed in the same way with both the external account and with Avadian, so you’ll need to update one of them if they are not listed in the same way.

I am unable to link my external account using instant verification. How do I use micro-deposits to link my accounts?

To verify using micro-deposits, you’ll go to “Account Actions” then “Manage External Accounts” and select “Micro-Deposits.” You’ll then be prompted to enter the routing number, account number, and account type for the account you’d like to link. Once this information is entered, two micro deposits (small deposits in amounts less than $1) will be generated and sent to your external account (typically within five [5] business days).

Once the micro-deposits are received by your external account, select “Account Actions” then “External Account —Verify” from the online and mobile banking home page. You’ll then enter the amounts of the micro deposits. Once the account is verified, you will see the external account in your drop-down menu for transferring funds. You may “nickname” accounts in “Settings” then “Account Preferences.”

You may also nickname an account by clicking on the three dots above the balance and selecting “nickname.”

I'm trying to link accounts using micro-deposits. Why can’t I find my financial institution to link my accounts?

If you can’t find the financial institution you’re looking for in the “quick picks,” try entering the name in the “search” field. Try using more general terms instead of specific names.

If you still can’t find the financial institution, you can add an account manually. Click “Add a Manual Account,” then enter the name, type, and balance so Money Manager can more accurately reflect the current state of your finances.

I'm trying to link accounts using micro-deposits. Why can’t I link an external account?

Only financial institutions in the United States can be linked.

If the micro-deposits do not appear in your account within the required timeframe, contact the other financial institution to verify that you are using the correct routing number as some institutions do not use the same routing number for all account types.

How do I make an auto loan payment if I do not have a checking account with Avadian?

There are several ways you can make an auto loan payment if you do not have a checking account with Avadian.

- Register for online banking at avadiancu.com to make loan payments, including transferring funds from an account at another financial institution.

- Add Avadian as a payee in your financial institution’s online banking platform. You can then manually make your loan payment each month or set it up to be paid automatically each month.

- Complete this form and return it to us to set up an ACH payment.

- Stop by your nearest Avadian branch.

- Mail a check to us at the following address:

P.O. Box 360287

Birmingham, AL 35236

How can I set up a recurring loan payment for an individual account?

You can set up a recurring payment within online and mobile banking or by calling Member Services at 1.888.AVADIAN (1.888.282.3426) or at your local branch.

To set up a recurring payment in online banking, log in to online banking then select “Payments and Transfers,” then “Loan & Visa Payments.”

You’ll select which account you want to transfer the funds from and select your loan. You’ll see the option to make the payment a recurring payment. Simply select this box, and you’re all set.

How do I set up a recurring loan payment for my business account?

To set up a recurring payment, you will need to have the payee set up a recurring Electronic Funds Transfer. They will probably have a form for you to complete with your account number and Avadian’s routing and transit number (262087528).

Businesses cannot use online Bill Pay to set up a recurring loan payment.

Late Payments

At what point is my credit card payment considered late?

Avadian Visa credit cards do not have a grace period and are considered late when the Payment Due Date is past.

At what point will I be charged a late fee on my auto loan payment?

Auto loans have a grace period of 10 calendar days before a late fee is incurred.

How do I get a 10-day payoff on an auto loan?

To get a 10-day payoff amount on an auto loan, you will need to contact Member Services at 1.888.AVADIAN (1.888.282.3426), send us a secure message inside online banking, or visit your local branch. This is not something that we can give you over social media channels.

Can I check the status of my loan application?

You can check the status of your application (except mortgages) here.